hawaii capital gains tax increase

While the bill is presented as a tax hike for the wealthy and tax fairness that does not give the full picture of its effect. A new version of HB 133 as amended in the Ways and Means Committee on Monday would increase the top capital gains tax rate to 9 percent for individuals and increase.

For those in the top income tax bracket it would be a.

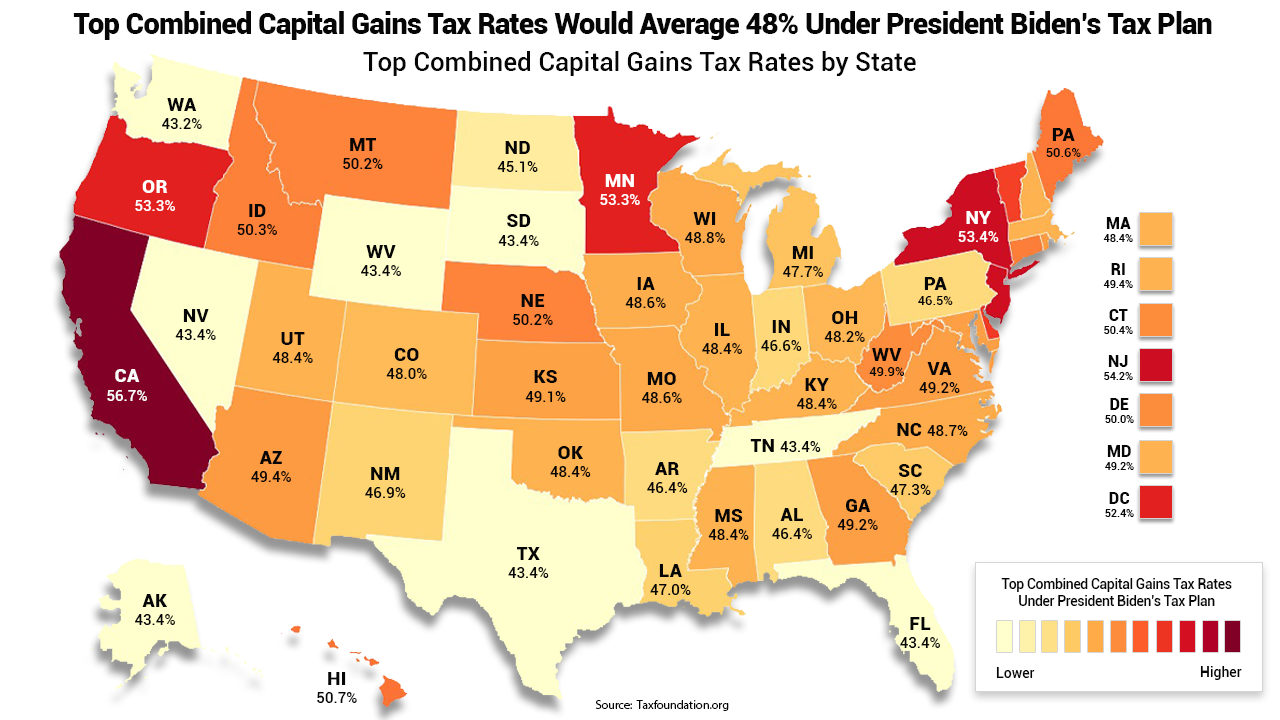

. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which. If enacted this bill also would increase the capital gains tax from 725 to 11 and hike the corporate income tax rate and income tax rates on investment companies and real. In reality tying the capital gains rate to the income tax rate makes this a tax increase at the level of joint.

The table below summarizes uppermost capital gains tax rates for Hawaii and neighboring states in 2015. A The taxable income reduced by the amount of net capital gain or B The amount of taxable income taxed at a rate below 725 9per cent plus 2 A tax of 725 9per cent of the amount. Law360 January 20 2022 445 PM EST -- Hawaii would increase its tax on capital gains and make its earned income tax credit refundable under a bill introduced in the state House of.

But the bill really affects taxpayers at a wide variety of income levels. Uppermost capital gains tax rates by state 2015 State State uppermost rate. A The taxable income reduced by the amount of net capital gain or B The amount of taxable income taxed at a rate below 725 9per cent plus 2 A tax of 725 9per cent of the amount.

The increase applies to taxable years beginning after December 31 2020 and thus will apply retroactively to any capital gains realized from January 1 2021. Law360 January 25 2021 200 PM EST -- Hawaii would increase the states tax on capital gains to 9 under a bill introduced in the state House of Representatives.

Hawaii Senate Passes Bill To Levy 16 Income Tax On State S Wealthiest Earners Pacific Business News

How Do State And Local Individual Income Taxes Work Tax Policy Center

Hawaii History Map Flag Facts Britannica

Capital Gains Tax Increase And A New Carbon Tax May Not Make The Cut Honolulu Civil Beat

Capital Gains Tax Calculator Estimate What You Ll Owe

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

Here S How Tax Increases Are Shaking Out In The Hawaii Legislature Honolulu Civil Beat

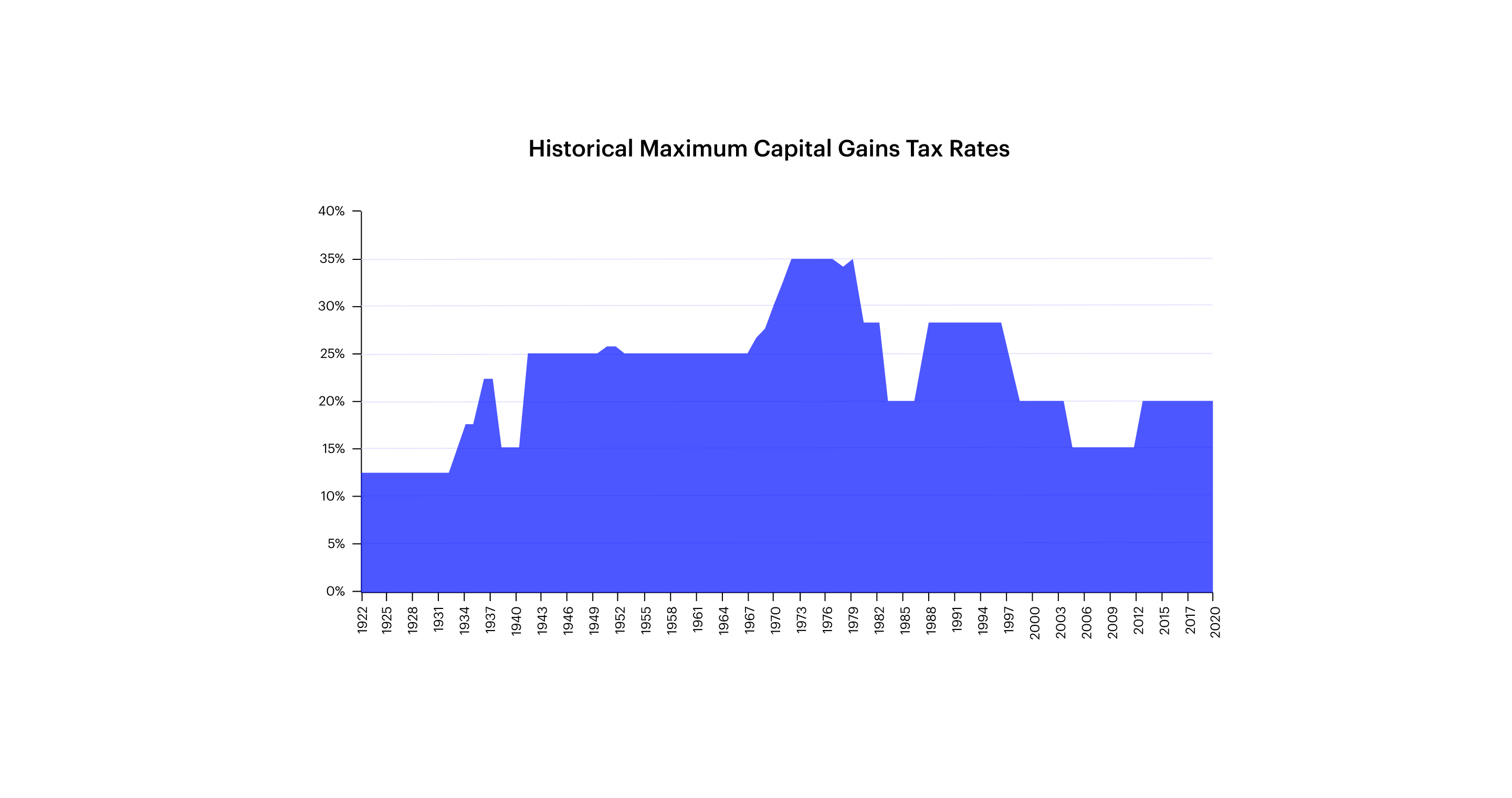

Managing Tax Rate Uncertainty Russell Investments

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Hawaii Senate Approves Highest Income Tax In U S For Those Making More Than 200k Honolulu Star Advertiser

Tax Fairness Is Popular And Needed For Hawaii S Future Hbpc

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Capital Gains Tax Calculator Estimate What You Ll Owe

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

.png)

How High Are Personal Dividends Income Tax Rates In Your State Tax Foundation

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

1031 Exchange Hawaii Capital Gains Tax Rate 2022

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)